Key Takeaways

Must differentiate between new case count & severity

Hawkish surprises with the dot plot could unsettle the markets

Inflation has resulted in a few market positives

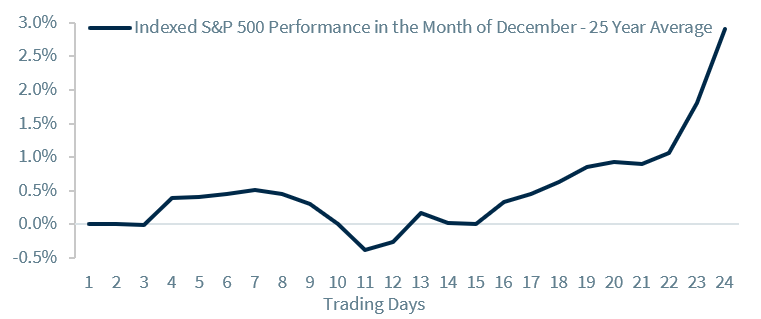

Have the tables turned? The S&P 500 is just shy of its level prior to the World Health Organization declaring Omicron a “variant of concern.” In the days that followed this announcement (on November 26), rhetoric from the Fed suggesting a potential acceleration in bond tapering compounded investor fears and resulted in the index declining ~4.1% from its recent high. But now, just two weeks later, positive developments related to the severity of Omicron have helped the equity market rebound and keep our hopes for a holiday-induced rally on the table. Next week, the big test will be the Fed meeting with its latest thoughts on the economy. Assuming no major surprises at the meeting, this could clear the deck for the S&P 500 to improve its already impressive rally (up ~26% YTD!) into year end.

Initial Data Tables The Worst Case Omicron Outcome: Preliminary data suggests that while the Omicron variant is more transmissible than previous strains, its symptoms tend to be similar, if not milder, than prior strains. In fact, thus far, neither hospitalizations nor deaths have risen drastically despite a rapid case increase in South Africa, where the variant was first identified. This continues to suggest that the market is differentiating between the new case count versus its severity. The recent equity rebound reflects the perception of the avoidance of the worst possible outcome—severe illness, burdened health care systems, and a surge in deaths—across the globe. Pfizer’s research that its three-shot vaccine regime ‘neutralizes’ the variant increased confidence in the current ‘toolbox’ of vaccines and coincided with the equity market rebound nearing previous highs.

Fed Will Lay All Its Cards On The Table: Next week’s Federal Open Market Committee Meeting (December 14-15) is likely the last major economic event of 2021. Commentary on the pace of bond tapering, the release of the updated economic projections, an updated ‘dot plot’ and Chairman Powell’s press conference will provide plenty of economic insights to unpack. Our expectation (and the market consensus) is that tapering will be increased to $30 billion/month; their economic projections will include slightly higher inflation forecasts and improving employment conditions; the ‘dot plot’ will suggest two rate hikes in 2022; and Chairman Powell will thread the needle in regard to acknowledging near-term inflationary pressures while remaining confident the Fed’s policy is ‘not behind the curve.’ However, any ‘hawkish’ surprises where the ‘dot plot’ suggests more rate hikes than expected or if the Chairman seems more concerned about inflation could unsettle the markets.

What Could Inflation Bring To The Market’s Table? While inflation has increased consumer prices at the fastest pace since 1982, the economy is not necessarily the equity market. This year, inflation has supported the equity market in several ways:

Earnings Growth To Keep A Good Table: Contrary to what many investors believe, inflation has been a positive for the market. Why? Because companies have been able to raise their prices (in the midst of healthy demand), increase margins to record levels, and help S&P 500 earnings grow an estimated 48% this year—the best earnings growth since at least 2000.

The Budget Reconciliation Bargaining Table: Apprehension over inflation have concerned moderate Democrats such as Senator Manchin and Senator Sinema about the size of the potential human infrastructure package. As a result, the size of the bill has shrunk from as high as $6 trillion to ~$1.75 trillion, with tax increases, for the most part, being withdrawn. With the corporate tax rate remaining at 21% (and not moving up to at least 25%), margins are likely to remain healthy and support robust earnings growth into 2022. We expect another year of above-average, double-digit earnings growth in 2022.

Set The Table For Wage Gains: Healthy wage increases had been elusive for decades, particularly for low-income earners. Now, hourly earnings are rising 4.8% on a year-over-year basis, and a tight labor market has led companies to offer increased pay as well as other incentives (e.g., tuition reimbursement) in order to attract and keep employees. The rise in disposable income has helped maintain an overall positive macroeconomic backdrop.

Next year, inflation could be a positive catalyst again not because it is increasing, but because it is decelerating. If our expectation of inflation peaking this quarter/early next year and than fading toward 2.5% (core inflation) as we progress further into next year is correct, there will be less pressure for the Fed to be aggressive in the pace and magnitude of their upcoming tightening cycle. Healthy growth, decelerating inflation, improving employment and a flexible Fed would be a positive for equities in 2022.