Key Takeaways

Companies have found new ways to operate post-Covid

Inflation surge as a learning opportunity for firms

Record net margins despite rising wages

Earlier this week we celebrated National Book Lovers Day, the perfect day to cozy up with your favorite book and read the day away! Whether you prefer fiction or non-fiction, paperback or electronic, a new release or one of the classics, reading is so important. And with more than 96% of the S&P 500’s market capitalization having reported results for the 2Q21 earnings season, we’ve been doing our fair share of reading as we comb through earnings call transcripts. While the ‘headlines’ from earnings are attention grabbing–healthy earnings growth, record sales beats, record margins and optimistic future guidance–analyzing the fine print from these conference calls–especially as it relates to forward guidance–provides even more color in understanding the state of the earnings environment as the next ‘chapter’ of this economic recovery unfolds.

An Earnings Season For The Record Books | The 2Q21 earnings season will unofficially end next week once retail giants Walmart and Target report, but our expectations for above-average results will be no ‘cliffhanger’ with spectacular earnings growth of ~+90% on top of 1Q21’s ~+50%. The magnitude of earnings beats remained far above the historical average at ~17%. As a result, the consensus 2021 S&P 500 earnings estimates have risen 20% since the start of the year, including 4% alone since the 2Q21 earnings season began, and are now just ~$1 shy of our expected $200 estimate! The below ‘cliff notes’ version of CEO commentary provides further real-time support of our macroeconomic views.

Will We Turn The Page On COVID-19? | While nearly a third of S&P 500 companies specifically referenced the Delta variant during their conference calls, most were sanguine about the recent surge of COVID cases, with Verizon stating that “people will continue to remember the value of connectivity.” However, given they reported most recently, travel-related companies displayed the most concerns. Booking commented that the Delta variant lends to some “volatility and uncertainty around the exact timing and shape of the recovery for travel,” but that their confidence in an eventual “strong recovery in travel demand globally” has not wavered. This was echoed by Expedia, who said they are still experiencing “relatively stronger performance compared to earlier parts of COVID.” In fact, some hotel companies such as Hilton observed that all of their “bookings for 2022 are at rates that are greater than 2019” and that momentum should carry into 2022 “simply because people have to meet.” Bottom Line: While COVID remains the biggest downside risk to the economy and earnings (especially in the services industries), full scale lockdowns are unlikely. Most companies continue to look through the recent surge highlighting that they have been resilient, finding ways to operate successfully in this new environment.

When Will The Inflation Chapter Come To A Close? | The presence and severity of supply chain disruptions varied across companies, but in the aggregate, the mindset was that inflationary pressures would be temporary. For example, Tractor Supply Co stated it is “starting to see (supply chain disruptions) moderate a bit” with ongoing improvements expected in the next 6-12 months. Some companies are viewing the situation even more positively, such as Microsoft sharing that the pandemic allowed them to revamp their sales, customer service, marketing, supply chains, and digital manufacturing with a “AI-first and collaboration-first” approach, and Ford, viewing the semiconductor shortage as a “huge opportunity to learn how to manage the supply chain differently” and better position themselves against a black swan event in the future. Bottom Line: Inflation has helped corporate earnings as modest price increases have been absorbed by consumers. However, as supply chain disruptions improve and inventories increase, inflationary pressures should subside by year end.

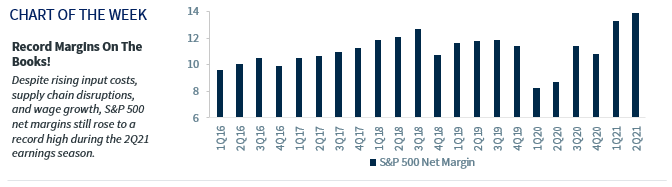

Are Companies Using Every Trick In The Book To Attract Workers? | With the US labor market having a record 10 million job openings, some companies, such as Caterpillar, vowed that this labor shortage is “transitory in terms of the friction of getting people into the right jobs,” but others are taking action to attract and retain workers. Retailers and restaurants such as Ross Stores, TJ Maxx, Target, Walmart, Starbucks, Chipotle, and Kroger have all announced wage increases, bringing the average hourly wage for grocery and food and beverage workers to ~$15 per hour for the first time. Despite rising wage costs, corporate margins are at record highs— which companies like Starbucks attribute to heightened productivity and “continued investment in digital initiatives and operational efficiencies” that “further solidify the foundation” for future growth. Bottom Line: Improvements in the labor market, in terms of the number of jobs added and wage growth, should bolster the spending power of the consumer and allow the Fed to begin tapering by year end.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Adam should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Wealth Manager.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your wealth manager and should be read carefully before investing.