Key Takeaways

Debates on stimulus & the debt ceiling still to come

Updated dot plot may shift rate hike expectations

Fda approval will lead to boosters & new mandates

As Labor Day, the unofficial end to summer, draws near, investors have either returned from or are taking the last of their vacations. Meanwhile, the equity market has done some traveling of its own, soaring to new record highs and rallying over 6% since Memorial Day—far outpacing the 1.3% average return seen over the Memorial Day to Labor Day time period since 2000. And to no one’s dismay, the index has avoided the summer slump historically seen during these hotter months. In fact, the S&P 500 has avoided a 5%+ pullback for ten months! This performance has dispelled another market myth that investors should ‘Sell In May And Go Away.’ Despite this healthy performance, we remain optimistic the upward ascent will continue. But the truth is that this may be a ‘September to Remember’ as it is packed with economic and political events that may lead to increased volatility.

Shaping What Biden Will Be Remembered For | President Biden made significant headway on his campaign promises in the first few months of his presidency, but the political environment is set to become more challenging.

Spending Too Much Or Too Little | The fate of the $1 trillion ‘physical’ infrastructure bill and the $3.5 trillion ‘social’ infrastructure package will likely be determined in September. House Speaker Pelosi has set a non-binding date of September 27 (just three days prior to the expiration of the basic transportation spending authorization) for the House vote on the bipartisan, ‘physical’ infrastructure bill. The ‘social’ infrastructure bill will be more contested given the Democrats’ use of budget reconciliation, as they cannot lose a single vote in the Senate or more than four in the House. A ‘goldilocks’ agreement on the appropriate size will be difficult to achieve as centrists and progressives debate if the spending is too much, risking further inflation, or too little, failing to provide working class families with the security they need. Our base case is that the total combined value of both packages will be $2 to $3 trillion (not the proposed $4.5 trillion), which may limit the magnitude of corporate and individual tax increases. Complicating matters are the expiration of extended unemployment benefits (9/6), potential for a government shutdown (9/30) and the ongoing need to raise the debt ceiling.

Recall Election In A Democratic Stronghold | California holds a recall election on September 14, and the continuation of Democratic Governor Newsom’s term is a toss-up in the polls. If recalled, there is a growing probability that a Republican could win. While the outcome does not impact DC, it could be a harbinger of the mid-term elections. While still more than a year away, PredictIt has the probability of the Republicans winning the House and Senate at 71% and 54%, respectively.

Few Approve Of Afghanistan Approach | According to NBC, only ~25% of Americans believe the Afghanistan withdrawal was handled favorably, with the deadline for removal set for August 31. President Biden’s approval rating falling below 50% for the first time could limit his political capital in getting his full domestic agenda (e.g., infrastructure packages) passed.

May Be The Most Important Fed Meeting In Recent Memory | The September Federal Open Market Committee Meeting (September 21-22) will likely serve as an inflection point for monetary policy. By this time, the Fed will have the August employment report (released September 3) that is forecasted to become the third consecutive month of 800k+ jobs added and they will get the opportunity to analyze additional inflation reports. Our expectations for the meeting include:

Taper Timeline | We expect tapering will begin by the end of this year and conclude by 4Q22. However, the starting point may be shifted earlier if the jobs report impresses, or later if economic uncertainty surrounding the Delta variant prevails.

Key Details of the Dot Plot | The dot plot gives insights as to when each Fed member foresees interest rate hikes. We expect the Fed will remain patient and not raise rates until 2023, consistent with the prior dot plot update in June. However, only three additional votes are needed (of the 18 voters) to shift the first interest rate hike expectation to next year.

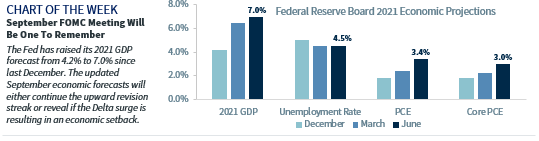

Updated Economic Forecasts | Since the December Meeting, the Fed has significantly raised their 2021 economic growth forecast (+2.8%), lowered their unemployment rate target (-0.5%), and modestly raised their core inflation expectations (+1.2%). The updated assumptions, including 2022 forecasts, should give more insights into the timing and pace of tapering.

COVID Containment or Contagion? | While our Healthcare Policy Analyst believes that the recent surge in COVID cases is nearing a peak, new cases will need to be monitored as students go back to school and some employees go back to work. September is likely to see two critical developments: 1) Moderna and J&J are likely to follow Pfizer in getting full FDA approval for their respective vaccines and 2) each of them is likely to get approval for administering booster shots.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Adam should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Wealth Manager.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your wealth manager and should be read carefully before investing.