Key Takeaways

US economy will gain momentum heading into 2022

Companies taking action to mitigate supply chain issues

Productivity gains will keep margins at healthy levels

Tomorrow is National Dictionary Day! Whether spoken or written, the power of words is undeniable. And as your Investment Strategy Team, we choose ours wisely, as to not create confusion when communicating our views. But for the next three weeks, we’ll be doing more reading than speaking as ~390 companies representing ~87% of the S&P 500’s market capitalization share their 3Q21 earnings season results. While these calls will recap their performance from the previous quarter, the forward guidance will ‘express’ their views after the temporary slowdown in economic momentum, address the ‘pronounced’ inflationary pressures, and ‘define’ their outlook for the final months of 2021 and beyond. Ahead of these timely releases, we’re detailing some of the messages that we believe will be conveyed and some of the trends that are likely to emerge this earnings season.

Companies Are Not Lost For Words On The State Of The Economy | The surge in the Delta variant, political uncertainty, and a slower than expected labor market recovery appear to have led to a temporary slowdown in the economy, with the Atlanta Fed GDP NOW estimate decelerating to as low as 1.3% for the third quarter. But that is ‘old’ news as our real-time indicators suggest that since late September, economic activity has regained its momentum. That is why, in addition to results, management conference calls will likely highlight this dichotomy between the ‘September Slowdown’ and the reenergized economy heading into the holiday months. In fact, we’ve already seen some early commentary confirming this. For example, Delta Airlines confirmed that the delayed office returns slowed progress for business travel during August and early September, but that they’ve posted their best week of corporate travel since. Ultimately, we expect the US economy will end the year strong and that momentum will carry over into 2022.

Earnings Could Not Be Beyond Words Forever | During Q2, earnings growth on a year-over-year basis reached a record 92%. While the 28% growth projected for Q3 doesn’t seem as notable, it is important to put it into perspective—it is nearly 4x the average over the last 15 years! Similarly, sales growth will be above average, as the projected 14% increase will be the second strongest quarter over the last 10 years. But both earnings and sales growth are expected to slow as economic growth gets back to a more ‘normalized’ time period. In fact, S&P 500 2022 earnings growth is expected to slow to ~10% (adjusted for the likely increase in corporate taxes to 25%), but that should remain supportive of a continued bull market. Another dynamic to put into perspective is that the five quarter streak of an aggregate earnings surprise of 15%+ is likely coming to an end. That level of ‘beats’ is unprecedented and likely to be ‘only’ 8% to 10%—still almost double the historical average!

Companies’ Actions Are Speaking Louder Than Words | Consumer spending is up ~19% from pre-pandemic levels, and still eager shoppers are exacerbating supply chain disruptions, creating what Oracle appropriately called a “high-class problem.” As long as demand remains strong, companies will work to contain and unlock the supply issues to maximize their profits. To echo JPMorgan CEO Jamie Dimon: “there’s not one company that is not working aggressively to fix their supply chain issues.” Companies will have to continue to convince the market that their tactics (e.g., Costco chartering ships, Lennar undergoing SKU reductions, FedEx expanding hours of operation, etc.) to unlock the supply constraints will be successful to power another healthy earnings environment in 2022. The bottom line, we are confident in the resiliency and flexibility of US companies to alleviate much of these pressures by mid-year 2022. (Opening the LA and Long Beach ports 24/7 helps as well!)

Word On The Street Is That Margins Will Contract | In the aggregate, increased commodity prices, logistics challenges, and increased wages have led to concerns about margin contraction. Thus far, those concerns have been unfounded as S&P 500 margins have expanded to record levels. Margins are likely to remain resilient with just a small deceleration as productivity gains remain supportive. With most companies thus far stating that the ‘worst’ of these issues will occur between now and early next year, the rebuilding of inventories should be a positive tailwind for the economy and earnings in the year to come.

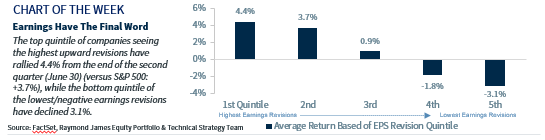

Earnings Seem To Always Have The Final Word | Since the start of the year, 2021 earnings have been revised 20.8% higher, a vastly different trajectory than the typical 4% decline, and the principal reason the S&P 500 has rallied 19.5% YTD. But beyond the aggregate level, the direction and magnitude of earnings revisions is impactful to individual stock performance. In fact, the top quintile of companies seeing the highest upward revisions have rallied 4.4% from the end of the second quarter (June 30) (versus S&P 500: +3.7%), while the bottom quintile of the lowest/negative earnings revisions have declined 3.1%. While headlines tend to focus on the magnitude of earnings and sales beats, the trajectory of earnings revisions is just as critical.