Key Takeaways

U.S. has already taken steps to combat omicron

The Fed’s quantitative easing goals have been met

Inflationary pressures are starting to peak

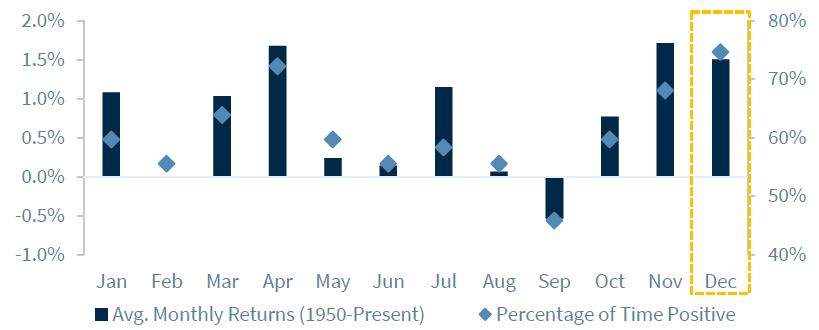

Will we have a ‘December to Remember?’ Or one we want to forget? The S&P 500 is having a volatile start to what is historically (since 1950) a cheerful time for investors, with the index up 1.5% on average and positive 75% of the time in the month of December. Unfortunately, seasonality is not the best long-term indicator of equity performance, and the catalysts causing the weakness at the end of November are not yet distant memories. The resilience and magnitude of the current bull market have left investors feeling complacent, fortunate to experience only one 5%+ pullback so far this year versus the average of at least three. With the markets overlooking COVID and the potential for less accommodative Fed action for the last several months, it is prudent to address the impact of these risks on our outlook.

The U.S. Has Committed COVID Tactics To Memory | As we entered what was expected to be a more ‘normal’ holiday season, investors had largely shrugged off COVID as a major risk after the economy and equity market remained resilient through the Delta surge. This was reflected by the results from our most recent Quarterly Investment Strategy Survey. While COVID was the biggest concern at the start of the year, it had dropped to sixth place as of the end of September. Now, with cases rising across the globe and the World Health Organization deeming omicron a “variant of concern,” the fears have reemerged. However, within just a few days, the US enacted stricter testing requirements for travelers, extended the mask mandate for public transportation from January to March, and encouraged employers to pursue vaccinations or weekly testing. These steps have helped guide us to this current stage of the pandemic and, as Chairman Powell noted in his address to Congress, they are the same enforcements that have allowed the economy to weather each new surge better than previous.

Bottom Line – Bear In Mind, Medical Insights Are Still Needed | Early reports suggest that the Omicron variant is more easily spread and associated with subdued symptoms, but the actual transmissibility, severity, and evasiveness against available vaccines and therapeutics are still uncertain. Even the medical experts – from the CDC to Moderna to Pfizer to Oxford – have varying opinions. The best case scenario is that the variant does not become mainstream, but our base case is that the symptoms are mild, with existing vaccines protecting against hospitalization and death. In the more tragic scenario, we’d expect new vaccines introduced at an expedited pace. Until there is enough evidence to provide clarity, we’d avoid any emotion-driven decisions to adjust portfolios, and remain confident that there would be ‘all hands on deck’ to mitigate the surge.

If Memory Serves Correct, The QE Goals Had Been Met | In his testimony to the Senate Banking Committee, Fed Chair Powell acknowledged that the Fed may accelerate the pace of reducing bond purchases (currently at $15 billion/month to end in June) at the December Federal Open Market Committee (FOMC) Meeting, and he stated that the word ‘transitory’ should probably be retired when it comes to describing inflation. First, we’ve argued since mid-year that the Fed should taper in a swifter fashion given that the desired outcomes of quantitative easing—increased confidence, narrowed credit spreads, raised asset prices, and reduced market volatility—had all been achieved. With the government issuing less debt, the need for the Fed to absorb Treasury securities in an effort to keep interest rates low is no longer necessary, and the economy would be better off if the Fed had the ability to save this tactic for the next ‘emergency.’ When it comes to the word ‘transitory,’ we’ve long argued that the definition varies amongst policymakers, CEOs, economists, and investors, therefore its use has led to more confusion than explanation. We place less emphasis on the semantics, as we continue to monitor real-time data that suggests inflationary pressures are in the process of peaking and the realization of disinflationary pressures could be feasible by this time next year.

Bottom Line – Economic Data Should Refresh Our Memory | The markets are assuming that if bond tapering is accelerated, the liftoff for the fed funds rate may come sooner. But if the data-dependent Fed does so, the decision would have to be justified by the strength of the economy. With the ISM Manufacturing Index near all-time highs, initial claims near the lowest levels in decades, and the unemployment rate falling to a post-pandemic low of 4.2%, there are plenty of signals of strength. In fact, economic momentum for the fourth quarter has surged, with the Atlanta GDP Now at 9.7%. However, we expect this pace to moderate to 3.5% in 2022 and that inflationary pressures will begin to dissipate. We’re already seeing commodity prices stabilize and real-time data suggests that bottlenecks are starting to fade. All of this should afford the Fed flexibility and allow it to exercise patience in determining when to begin its next tightening cycle.