Key Takeaways

Food prices may rise if conflict lingers into planting season

Russian economy dependent upon natural gas exports

Russian oil ban will not cause a repeat of the 1970s

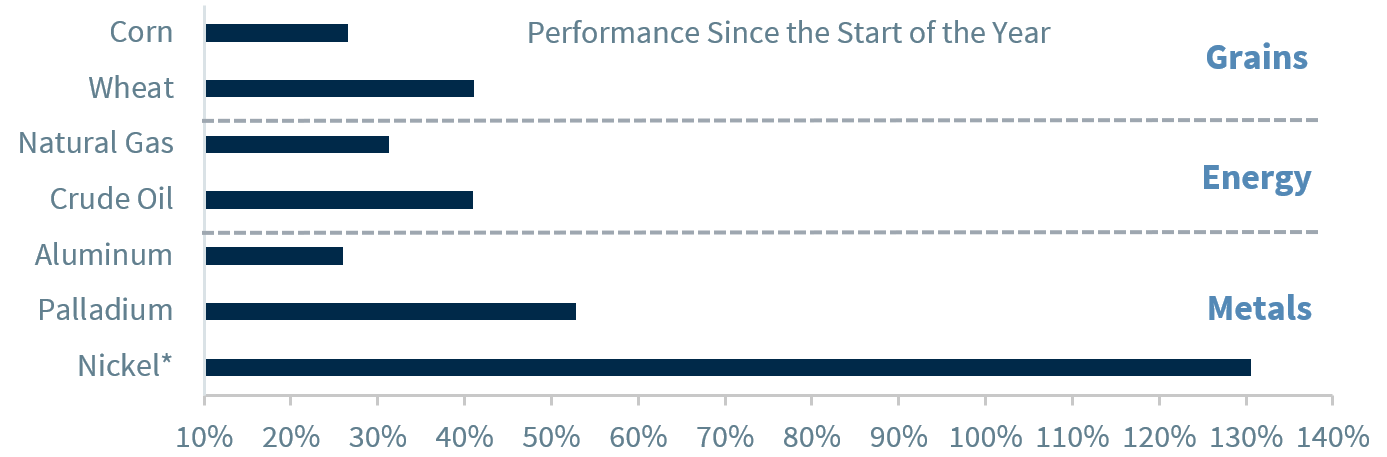

Are we in the midst of a commodity super-cycle? That is a common question amongst investors as commodity prices surge as the tensions between Russia and the Ukraine extend into the 16th day. In prior Thoughts On The Market publications, we discussed that while Russia and the Ukraine combined represent a small portion of the global economy (~2%), they provide an outsized exposure to several key commodities. Below we discuss the surging costs of grains, energy and metals, and the complications that may result if a resolution is not soon reached. The longer the Russia-Ukraine crisis persists, the greater the potential of negative consequences for the global economy (e.g., higher commodity prices ‘taxing’ consumers) and the Russian economy (e.g., coordinated sanctions).

Will There Be Wheat Shortages? | Russia and Ukraine, combined, produce 30% of the world’s wheat and due to the ongoing conflict prices have soared to the highest level in 14 years. While Russia’s planting and harvesting seasons are likely to remain stable, the fears that Ukrainian farmers will be unable to plant, harvest, and ship their crops are growing. This is even more true knowing that many of Ukraine’s key exports (corn, barley, and sunflower seeds) must be planted in April—just a few weeks away! Farmers may be compelled to either join the fight or seek refuge, and there is also the grim reality that their farms may be destroyed as Russian troops make advances. To further complicate matters, Russia has ‘temporarily’ suspended fertilizer exports. So, without adequate supply, or simply due to higher prices, those who stay may experience less productive fields. There is also the fear that the final product will not be able to be shipped—with Ukraine’s infrastructure and shipping routes either damaged or under attack. Since wheat can be stored for a few months, shortages could start as early as the summer. It is important to remember that these grains are not only used for human consumption, but also to feed livestock. The European economy is arguably most at risk given that Ukraine is its ‘breadbasket’—responsible for ~14% of its grain imports.

Can Russia Cut Off Europe’s Natural Gas? | Russia supplies over 40% of the EU’s natural gas and that is part of the ~$1 billion that Russia receives each day from energy imports to Europe—a critical funding source now that Western sanctions have crippled its economy. The International Energy Agency has reported that Europe could feasibly replace more than half of its Russian gas this year. If action is taken, whether as a result of the continuation of the war or as a punishment for Putin’s aggression, this resource shift may have lasting, detrimental impacts on the Russian economy. In the meantime, this crisis has proven to be a boon for American liquefied natural gas (LNG). The US has been steadily growing its LNG exports, becoming Europe’s largest supplier in 2021 and providing ~26% of total imports. That being said, the US is maximizing production. While the aim is to increase output further by bringing the Calcasieu Pass export facility online, the US will still be unable to replace Russian exports in the near term. While US gas market prices remain more insulated than other countries’ because of domestic production, European natural gas prices may benefit as the weather becomes warmer (e.g., natural gas is mostly a winter fuel).

Will Banning Russian Oil Cause A Repeat Of The 1970s? | For investors who remember the 1970s oil crisis, President Biden’s oil embargo decision may have invoked fears of the hour-long gas station lines and astronomical prices returning. The good news is that this fear may be misplaced. First, the US is far less energy dependent. During the 1970s, our nation imported ~35-45% of its oil. Today, only ~7% of our imports come from Russia. Second, there are stockpile security measures in place today that did not exist back then. There are ~1.5 billion barrels of strategic reserves currently held by IEA countries. Given that Russia exports ~7.5 million barrels per day, the entire Russian industry could be shut down for over six months (at a minimum) before these stockpiles would be exhausted. Third, a coordinated oil embargo against Russian oil would be challenging. Energy-dependent Germany was quick to express reservations and asking emerging economies such as India and China to not buy what would likely be discounted oil would be problematic. So far, with global production little changed in aggregate, our energy analyst believes oil prices (which hit $123/barrel this week) are pricing in a worst-case scenario in supply reductions; but we anticipate that this ‘war’ premium will diminish if an off-ramp for the conflict emerges soon.

Will Critical Metals Be Available? | Nickel prices surged above $100,000 per ton amid fears Russia would halt its exports. While the gains in nickel (and other metals such as palladium and aluminum) have eased since, the market was pricing in a worst-case scenario—that Russia’s production could not be replaced. The rise in nickel prices tends to be reflected in the cost of bigger one-time purchases (e.g., electric vehicles, appliances) rather than daily purchases (e.g., food and gasoline prices). As a result, shortages may further disrupt supply chains as companies seek other suppliers or alternatives. A continuation of the conflict could delay the peak in producer inflation as companies continue to grapple with higher input costs.