Key Takeaways

The economy can absorb the Fed’s interest rate hike

Buybacks are on the rise given current valuations

Ukraine expresses willingness to claim neutrality

This Sunday, March 20, is the first official day of the spring season! And while the spring season springs forth fresh blooms, warmer temperatures, and more daylight, it may also bring renewed hope for equities. On the financial front, we just experienced a ‘winter of negativity’ during which increased geopolitical tensions, recession fears, and market concerns have left the S&P 500 down ~10% year-to-date. But even through the S&P 500 has fallen back to the level from last July, there is reason to believe that the ‘forecast’ will improve not only for us, but for the equity market too. The increased uncertainty caused the market to enter correction territory, but we think there are five catalysts that could help the S&P 500 blossom in the months ahead – bringing it closer to our year-end target of 4,725.

Powell Springs To The Economy’s Defense | Amid the Ukraine-Russia conflict and soaring inflation, various economists and financial market pundits have made calls that the US economy was headed for recession. However, consistent with our view of the economy remaining robust, Chairman Powell used the Federal Open Market Committee’s March Meeting to assuage these fears. In fact, he stated that the odds of a recession are not “particularly elevated” over the next 12 months as “aggregate demand is currently strong” and is expected to remain so. We think resilient labor market conditions, healthy manufacturing, and a still strong consumer should help the economy grow at a healthy 2.7% this year. To echo Chair Powell once again, given that “all signs are that this is a strong economy,” it should be more than able to absorb the start of the Fed’s tightening cycle.

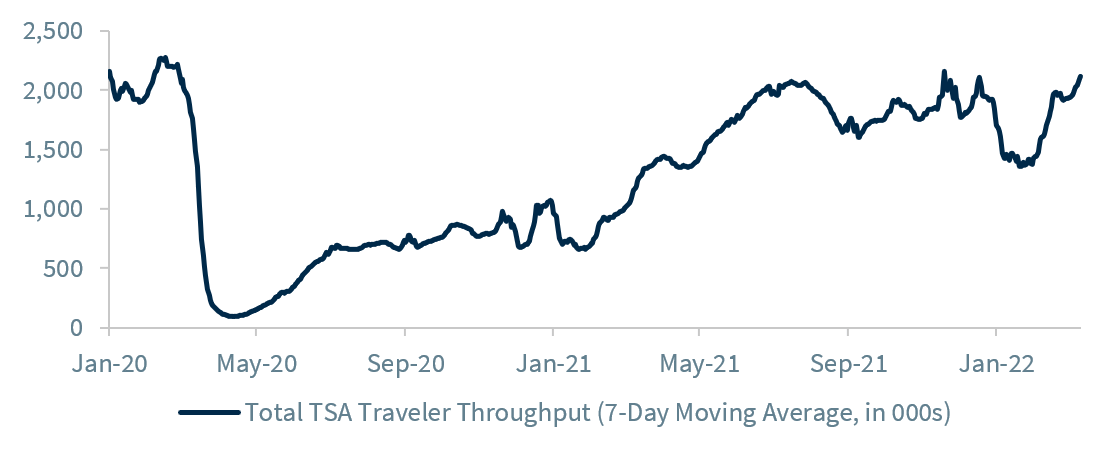

The Reopening Is Getting A Spring In Its Step | With the Omicron surge subdued and the seven-day average of new COVID-19 cases at the lowest level since last July, the reopening of the economy is gaining momentum once again. There are early signs that show elevated fuel prices haven’t stopped travelers. In fact, TSA traveler throughput is at its second highest level since pre-COVID (trailing only Thanksgiving). Restaurant reservations, hotel occupancies, and driving numbers also suggest that consumers are ready to start spending on services. Not convinced? Even the White House is preparing to reopen to regular public tours in April, after a more than two-year hiatus. The bottom line is that these real-time activity metrics all serve as evidence that the consumer is willing and able to spend as normal activities resume.

Earnings Growth Should Continue To Bloom | Despite the recent uptick in volatility, corporate earnings have been resilient. In fact, 2022 earnings have been revised higher by ~3.5% over the last six months, and are projected to grow 9% this year to reach our target of $225. Also important, the consensus earnings estimates for both 2022 and 2023 have remained near cyclical highs, reflecting our sentiment that the US economy will not enter a recession and that the economic fallout from the Ukraine-Russia crisis will not be long-lasting or of substantial magnitude.

Valuations Have Caused Buybacks To Sprout | After the recent sell-off, the price-to-earnings multiple for the S&P 500 is at the lowest level since May 2020. Since a recession is not our base case, the macroeconomic backdrop should be supportive of equities moving higher from here. Some long-term investors are using this as a buying opportunity, but just as important, many companies are as well. S&P 500 companies bought back an impressive $259 billion in stock last quarter, but have already outlined plans to repurchase ~$240 billion in the first two months of this quarter alone. So not only should it far outpace 4Q21, but it could potentially reach $1 trillion for the year! This is not the only shareholder-friendly action taking place either, as dividend growth should be ~8% for the year – the best since 2019 and the second best over the last seven years.

Hoping The Seeds For A Ceasefire Will Be Planted | As Russian and Ukrainian diplomats claim that negotiations are becoming “more realistic,” the devastation is yet to cease, and civilians are devastatingly being caught in the crossfire. The crisis is unstainable given the tragic loss of human life and the economic destruction, and we are hopeful an agreement will be reached sooner rather than later. Russia has drawn up a multi-prong plan with its provisions for a ceasefire, and Ukraine has expressed openness to claim neutrality (foregoing a path to become a member of NATO) in exchange for security guarantees that are legally verified. While the exact terms of the agreement are in state of flux, the apparent willingness to talk from both sides is a positive sign that a route to peace could (and hopefully) be on the horizon. And if a ceasefire and agreement are reached, the easing of geopolitical tensions would likely lead to a favorable reaction from equities.