Key Takeaways

Three consecutive negative quarters for bonds & equities

Good news becoming bad news for a more hawkish Fed

Anticipating a mild, not severe, recession

A September to remember? More like one we’d like to forget! After the Fed cautioned that the tightening cycle was far from over and that “some pain” would be ahead for the economy, the markets recalibrated Fed expectations (e.g., higher for longer) and accelerated concerns for a seemingly inevitable recession. It’s been a challenging year for investors, and this September slump has not made it any easier. In fact, the equity and fixed income markets are set to simultaneously notch three consecutive negative quarters for the first time in over four decades. As we enter the fourth quarter of this tumultuous year, we’re putting the volatility seen during the month of September into perspective, as well as giving our insights for the economy and financial markets in the months ahead.

Putting The Past Into Perspective | As much as we don’t like living in the past, sometimes it is important to take a step back. During a month when even good news was considered bad news (e.g., low jobless claims perceived as allowing for a more aggressive Fed), we’ve outlined just a few of the noteworthy market movements that have occurred over the last four weeks.

The Fed Funds Rate | While the Fed updated all of their economic projections, it was the increase in the terminal rate (e.g., peak rate) forecasts for 2022 and 2023 from 3.4% and 3.8% to 4.4% and 4.6% respectively that startled the markets. These adjustments not only signaled that rates will move well into restrictive territory, but that they would remain higher for longer. Currently, the futures market shows a slight probability (7%) of the peak rate approaching 5%—a level not seen since 2007.

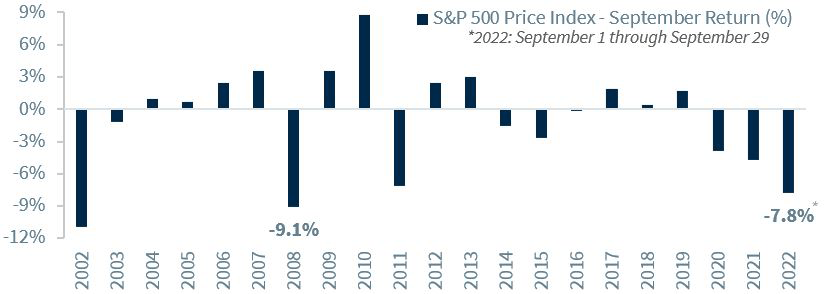

The Equity Market | The S&P 500 (-7.8%) is bracing for its worst September since 2008. Fears of a recession and aggressive Fed policy have caused the Index to fall to the lowest level since November 2020 and reenter bear market territory. With one day remaining, the S&P 500 has already recorded twelve +/- 1% daily swings this month. This is the second most since September 2020 (also 12 days)–surpassing November 2020’s nine days (when the COVID vaccine was found to be effective, and the presidential election ended) and falling only behind March of this year (14 days) due to Russia’s invasion of Ukraine.

The Fixed Income Market | The Bloomberg US Aggregate Bond Index is on pace for its second worst month since December 1981 due to the sharp upward movement in yields. On the shorter end of the yield curve, the 2-year Treasury yield rose above 4.3% for the first time since August 2007. On the longer end, the 10-year yield approached 4% for the first time since April 2010, and with a surge of approximately 60 basis points, this will mark the largest monthly increase since December 2009.

But Focusing On The Future | It is understandable that investors are growing weary due to the difficulties and unforeseen events experienced this year. And during these times of uncertainty (e.g., Fed, recession, Ukraine, elections, etc.), it can be difficult to imagine anything but the worst-case scenario unfolding. While our outlook for the next 12 months isn’t without challenges, we do not think a severe economic downturn and continued weakness for the major asset classes is what’s to come.

The Economy | The third consecutive 75 basis point interest rate hike lifted rates into restrictive territory, and the further the Fed moves above the 4% threshold the greater the likelihood of a recession. Since our peak rate forecast is 4.5%, we are anticipating a mild recession beginning in the first quarter of next year due to a housing market that is losing steam, elevated electricity/energy costs, weak sentiment across the board (businesses, consumers, investors), and the impacts of a stronger dollar (e.g., reduced export activity, hit to earnings for multinationals). However, we do not think the economy will experience a severe recession as there are no ‘excesses’ like the dot.com bubble and due to the continued strength of the labor market.

The Equity Market | The equity market is forward-looking. Therefore, the recent weakness is largely being driven by the realisation that the economy was not already but will soon be in the midst of a mild (not severe) recession. What could lead to a turnaround? Beyond inflation decelerating and allowing the Fed to ease hikes, the market needs better-than feared earnings for the upcoming third quarter earnings season. There are some positive seasonal trends too. In the last 19 midterm elections, the S&P 500 has been positive every time in the 12 months following and has been up 14% on average.

The Fixed Income Market | With yields at multi-year highs, investors are no longer in an environment where ‘there is no alternative’ to equities. Yields are at attractive levels for the first time in years, but as the economy slows and inflation abates, there will eventually be downward pressure. Our focus is on quality, whether it be Treasurys, investment grade bonds, or municipals; recession risk and the inversion of the yield curve make high yield bonds less compelling.